When entering or exiting a trade, there are many order types you can use. Keep in mind that while we use shares of stock in most of the examples, the same concepts apply to options.

The primary order types are market orders, limit orders, good-til-canceled orders, and stop-loss orders. The following graphic explains the differences between each order type:

Of these order types,

market orders should be avoided as much as possible. The only exception to this rule is if you absolutely have to get out of a position immediately. However, using limit orders at the bid or ask price is still preferable to using market orders when exiting positions in a hurry.

To fully understand how each of these order types works, let's walk through some examples.

Let's examine these order types with hypothetical trade examples.

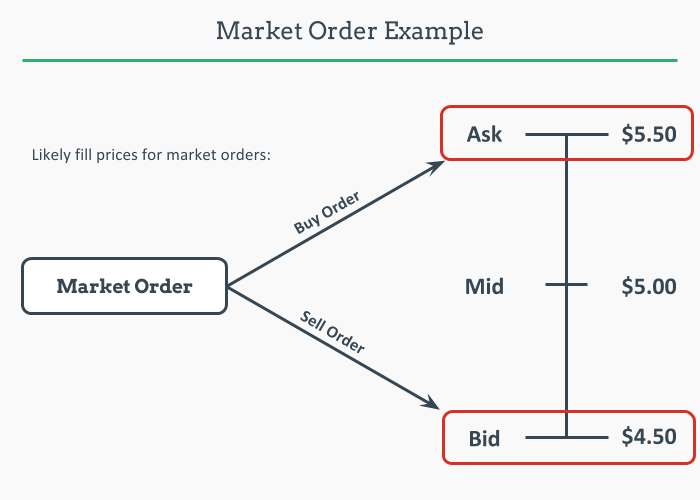

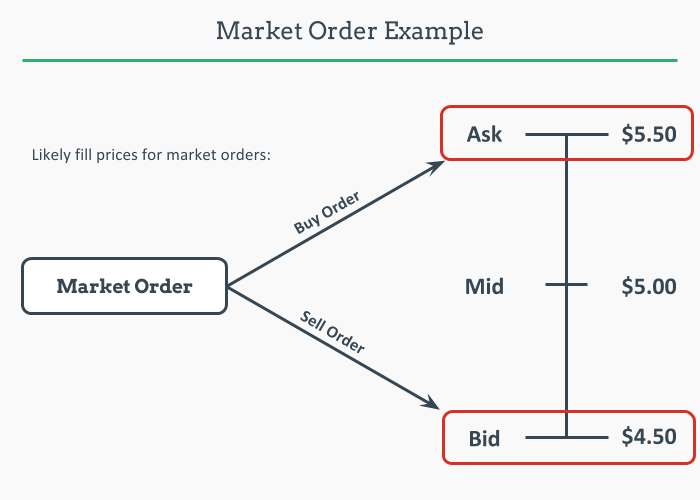

First, let's look at how a market order might be treated on an option with a bidding price of $4.50 and an asking price of $5.50:

Market orders need to be filled immediately, and the easiest places to fill a trade are at the asking price when buying, and the bid price when selling. So, if you use a market order, do not expect a fill near the mid-price.

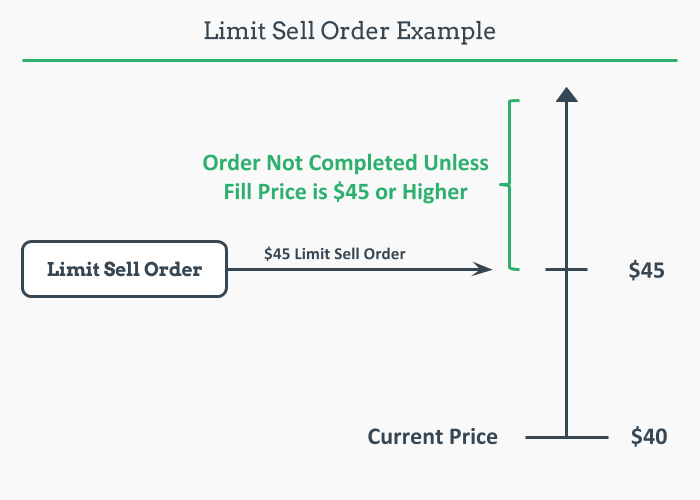

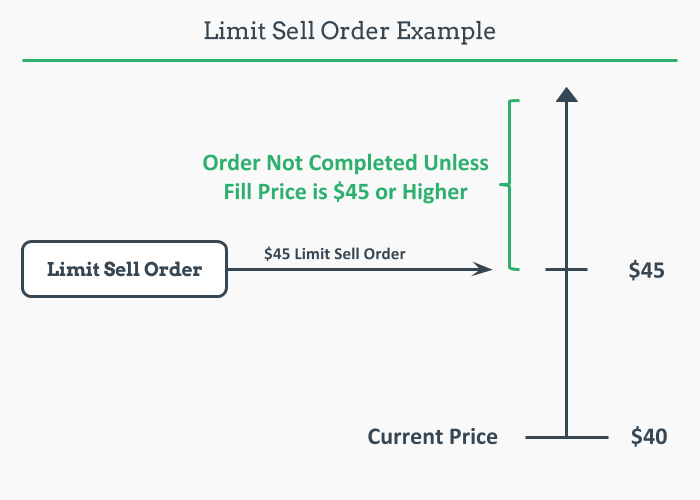

To understand how a limit sell order works, consider an investor who owns stock currently trading for $40 per share. If the investor wanted to sell their shares at a price of $45 or higher, they could route a limit sell order with a price of $45:

As illustrated in the above visual, a limit sell order with a price of $45 will only be completed if the shares can be sold for $45 or higher. Using a limit sell order is favorable because the worst case scenario for a fill is the price you specified, but you can also get filled at a more favorable (higher) price.

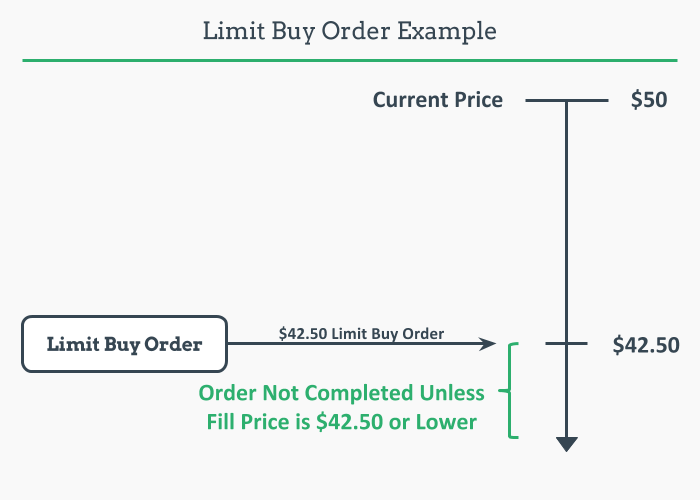

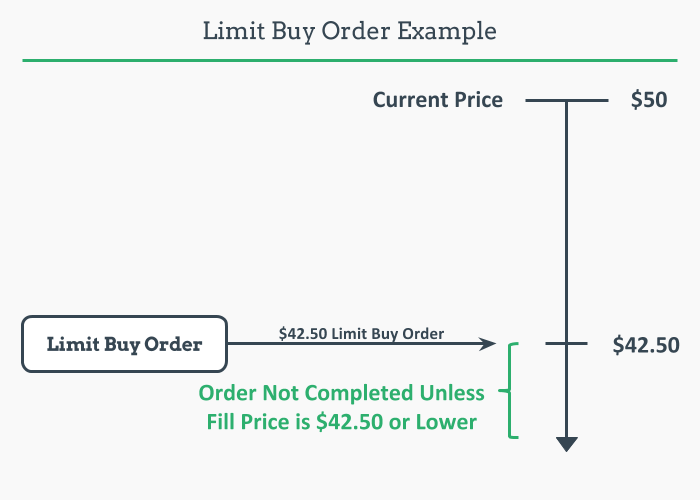

To understand how a limit buy order works, consider an investor who wants to buy a stock when it reaches a price of $42.50 or lower, but the stock is currently trading for $50. With a target purchase price of $42.50, the investor could route a limit buy order with a price of $42.50:

With a limit buy price of $42.50, the trade will only be completed if the fill price is $42.50 or lower. Limit buy orders are favorable because the worst price you can get filled at is the price you specify, and there's always a chance you get filled at an even better (lower) price.

If not filled or canceled, a limit order automatically expires at the end of the trading day in which the order was initiated (but may vary depending on your brokerage). However, if an investor wishes to keep a limit buy or limit sell order active for longer periods of time, a good-til-canceled (GTC) order can be used.

While "good-til-canceled" infers that the order will remain until canceled, brokerage firms may set a limit for the number of days a GTC order can be active. So, GTC orders will still expire at some point, but are still helpful to use for orders you wish to let sit for weeks at a time.

When an investor wants to automatically exit a losing trade when the stock or option reaches a certain price, stop-loss orders can be used. Stop-loss orders are typically market orders, but can also be limit orders (stop-limit). In this guide, we'll focus on regular stop-losses that use market orders.

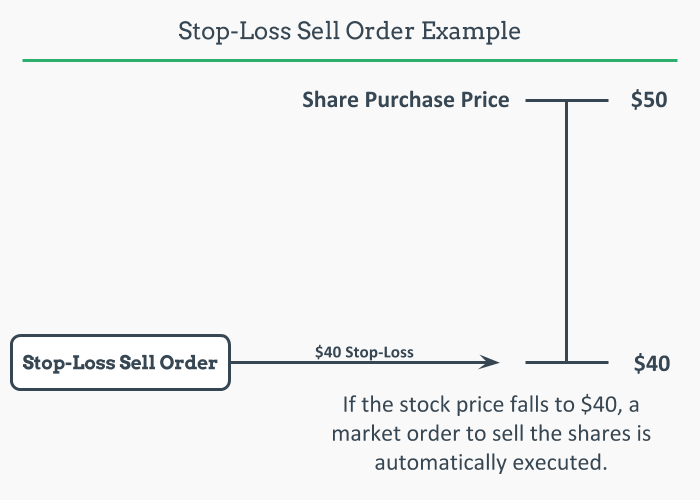

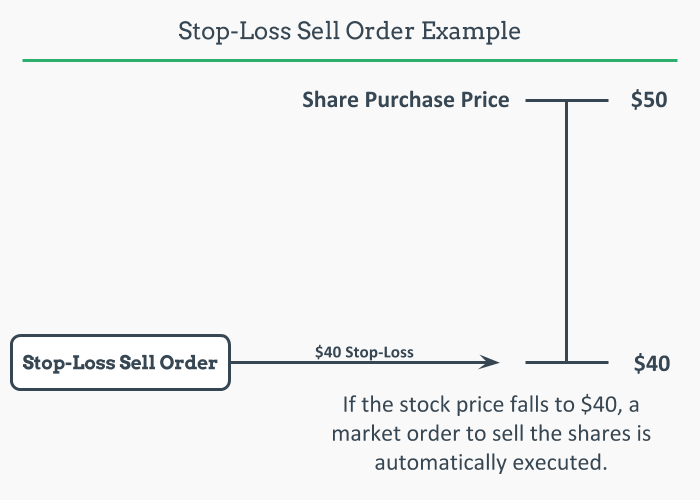

To understand how a stop-loss sell order works, consider an investor who purchased stock for $50 per share. If the investor wanted to automatically exit the position if the stock price falls to $40, a stop-loss sell order with a price of $40 could be implemented:

As soon as the shares trade $40, a market order to sell the shares will be executed.

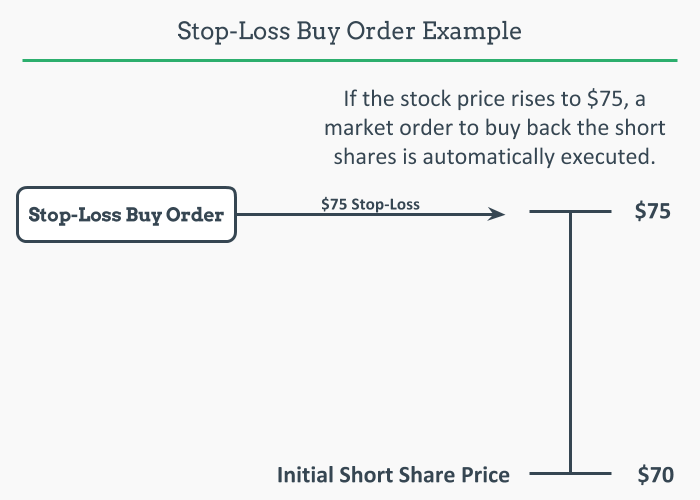

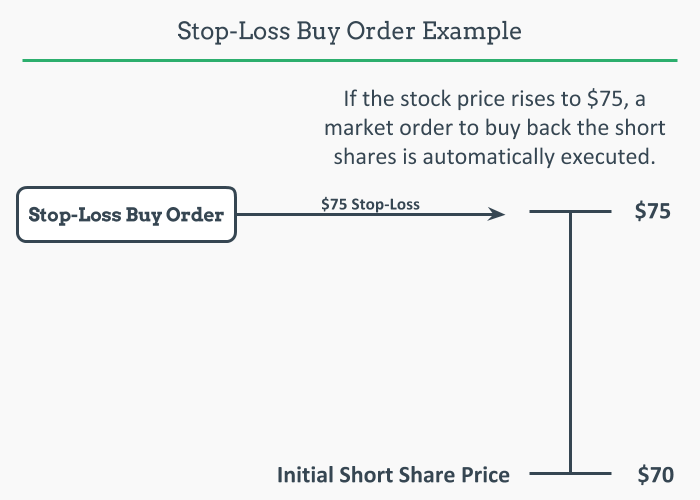

A stop-loss buy order can be used to close a short stock or option position when a certain price is reached. For example, consider a trader who shorts a stock at $70 per share. If the trader wanted to cut their losses when the stock rises to $75, a stop-loss buy order can be implemented:

If the shares trade $75, a market order to buy back the short shares will automatically be executed.

The stop-loss examples above assumed that an investor already had a long or short position in the asset before implementing a stop-loss order. However, it's important to note that stop-loss orders can be implemented without having a long or short position.

For example, if a trader routes a $100 stop-loss buy order on a stock they aren't short, the trader will automatically buy the shares if the stock rises to $100. Conversely, if a trader routes a $50 stop-loss sell order on a stock they don't own, the trader will automatically short the shares if the stock falls to $50.

Unless you're a trader using stop-loss orders for momentum-based entries, entering long stock positions at higher prices than the current share price or entering short stock positions at lower prices than the current share price doesn't make sense. Because of this, stop-loss orders should be canceled if the underlying positions are closed before the stop-loss orders are executed.

Post a Comment