By now you should understand what to trade and how to trade it.

So let’s take a look at examples of the scalping strategy in action.

In the real examples I take you through real scalp trades I took step-by-step.

You now know how to place support and resistance areas. You also know what a trend continuation looks like.

All you need to do to trade this strategy is put these two things together. I am now going to show you how to do this with a lot of examples. We will start with and AUD/USD short trade:

In the image above you see AUD/USD is in a downtrend. An area of support is placed at 0.7633 based on the bounces marked in green.

Sellers manage to break support at 0.7633. Buyers take brief control of price and push it up to the former 0.7633 support area.

Buyers make several attempts at closing above the 0.7633 area. Since buyers cannot close above the 0.7633 area, a short trade is entered. The short is entered because price is trending down and it is clear buyers cannot regain control of price.

Why is the setup above a good trade? Well, let’s do some quick and simple risk analysis on the setup. This analysis would be done when price hits the resistance area and struggles to break above it.

- The major trend is bearish, this indicates sellers are in control of price (one point for sellers)

- Buyers caused a minor reversal back up to resistance, this indicates that buyers have some power (one point for buyers)

- Price is at a strong area of resistance (one point for sellers)

- Buyers are incapable of closing above the resistance area (one point for sellers)

Sellers have three points, buyers have one point. This risk analysis is basic, we could do more complex risk analysis but a strategy like this does not need it.

The idea here is simple. You are using price action analysis to make an educated guess as to what will happen next. If sellers have control of the major trend and buyers cannot close above resistance, the bearish trend has a good chance of continuing. So, you make an educated guess that sellers will continue and you short, why is this profitable?

Okay, time for some example trades. These trades are all recent and they were either taken by me or members of the advanced course forum.

I am going to try and shoot some live trade videos for this strategy soon. When I do I will post them here.

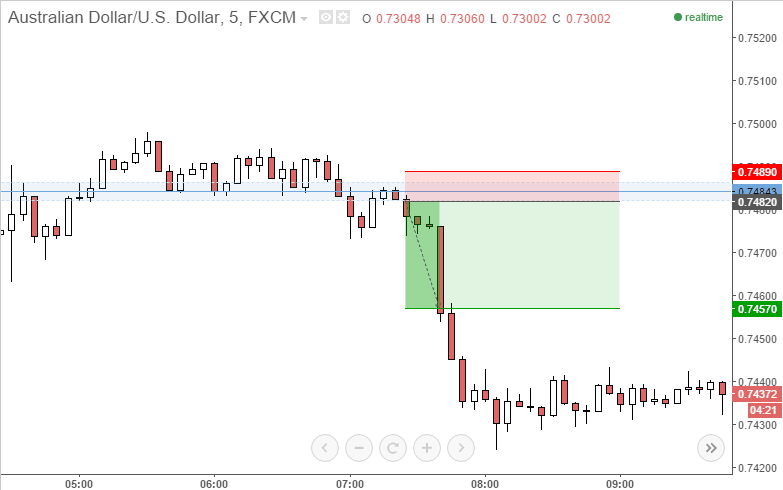

AUD/USD short trade

This was a very simple set up which formed on strong area of resistance. You can see clear bounces from the 0.7485 area over the course of ten hours. These bounces showed me obvious resistance in the area. Price eventually broke above the resistance area and resistance became support. There was actually a failed trade here which I will discuss later.

The short trade was taken after price broke below the 0.7485 support area. After the break, buyers pushed back up the the 0.7485 and tried to close above it. The fact that buyers could not close above the 0.7485 indicated that sellers were in control of price and that the bearish trend would continue.

A short trade was entered at 0.7482 at 07:25am UK time. The stop was 7 pips and the target was 21 pips. As you can see the target was easily met. The trade target was extended by 4 pips to 25 pips as there was great momentum. The overall risk to reward for this trade was 3.57, which is above the minimum of 3.

AUD/USD long trade

This trade triggered a few hours before the trade above. The set up was good but the trade never took off. The support and resistance area was placed at 0.7485 based on the first two bounces show in the image for the previous trade. When buyers broke above resistance price quickly dipped back down to test the area.

Sellers could not close below the area so a long was entered at 0.7488 at 5:50am. The trade’s target was 21 pips and the stop was 7 pips. This trade remained open for over an hour but in the end price dropped and hit the stop.

Could I have done something differently to save myself from taking a 7 pip loss on this trade? Maybe I could have, but it does not matter.

The key to trading this strategy is to just take the trade and let it play out. DO NOT close trades early and DO NOT widen your stops. If the trade fails it does not matter, all that matters is that you maintain a minimum of 1:3 risk to reward ratio.

If you take one hundred trades with this strategy and fail 60% of them you will still be profitable, have a look:

60 trades x -7 pips lost = -420 pips

40 trades x 21 pips won = 840 pips won

840 – 420 = +420 pips up

This is why it is vital to maintain a risk to reward ratio of 1:3 and this is why losses like the one above do not matter.

Trading Forex is not about being right, it’s about being profitable.

Let’s look at another recent example.

USD/CAD short trade

This recent trade example really illustrates why this strategy can be psychologically tough. It also shows you why you must stick to the 1:3 ratio, no matter what.

As you can see, the trade was open for only 10 minutes before price retraced to the entry. How do you handle this situation? Do you panic and exit? Do you calmly decide the trade is no longer good and exit?

NO!

You hold the trade. You need to trust your price action analysis and stick to the 1:3 ratio. Trades like this are quite common, trades will not always hit your target within 20 minutes. You need to be prepared to wait it out sometimes.

Open ECN Scalpling Forex Broker Account

Post a Comment