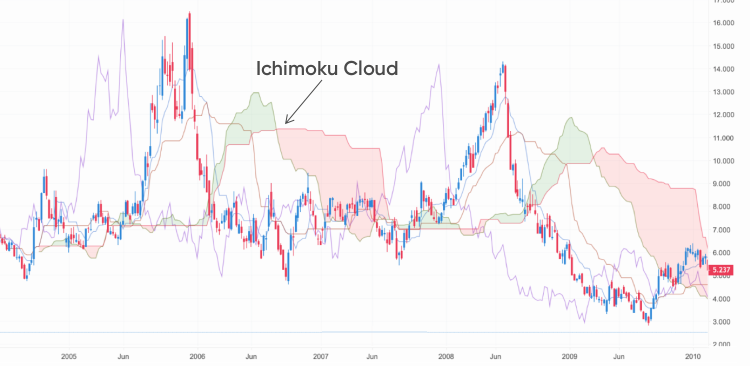

Forex Ichimoku Cloud System

What is the Ichimoku cloud?

The Ichimoku Cloud is a popular technical indicator designed to help traders learn everything about a market’s trend, including its momentum, direction, support and resistance levels and even trade signals. The Ichimoku’s full name – Ichimoku Kinko Hyo – is translated from Japanese as “instant look at the balance chart” or “one glance equilibrium chart.”Though it might look a bit scary at first sight, Ichimoku cloud can be really helpful even for new traders, highlighting support and resistance areas and trend direction.

Often used for various markets and timeframes, Ichimoku charts consist of five lines, each providing important information about the price movement. The area between two of them is filled in with colour, which creates a cloud-like view.

Who invented the Ichimoku cloud?

The Ichimoku cloud indicator was invented by a Japanese journalist Goichi Hosoda in the late 1930s. It took him almost 30 years to refine this innovative technical analysis tool before revealing it in 1969 to the public.The Ichimoku Kinko Hyo was designed to combine different technical analysis strategies in one single indicator that could be easily applied and interpreted.

Why is Ichimoku cloud useful for traders?

Ichimoku indicator is a solid trading framework. This comprehensive all-in-one indicator gathers a lot of useful information in one chart. Providing a clearer market picture at a glance, Ichimoku highlights support and resistance levels, identifies price direction and gauges momentum.Ichimoku signals enable traders to catch trading opportunities and spot the most optimal entry and exit points. With the help of the Ichimoku cloud, traders may filter between longer-term up and down trends.

The fastest-moving Ichimoku components – conversion and base lines – provide early momentum signals. Just like Moving Averages, the Ichimoku strategy can be also used to identify trade exits and place stop-losses.

Technical analysis: how to trade with Ichimoku cloud?

The all-in-one Ichimoku cloud indicator includes 5 major components with the following interpretations:

- Tenkan-sen (or the Conversion line)

This line represents support and resistance levels and is the signal line for price reversal. It is also referred to as a turning line. Moving down or upwards, Tenkan-sen indicates the direction of the market’s trend.

- Kijun-sen (or the Base line)

Kijun-sen is a confirmation line, or the line representing support and resistance. It can also serve for using trailing stops. This line indicates the future price movement of the market. If the price is above the Kijun-sen line, it has the potential to move up further; if the price is below this line, it may keep falling.

- Senkou span A ( or the Leading span A)

Also referred to as the Leading span A, this line represents one border of the Ichimoku cloud, or Kumo. When the price is higher than the Senkou span, the top line acts as the 1st support level, and the bottom line acts as the 2nd support level. When the price is lower the Senkou span, the bottom line becomes the 1st resistance level, and the top line serves as the 2nd resistance level.

- Senkou span B ( or the Leading span B)

Also referred to as the leading span B, the line represents the other border of the cloud, or Kumo.

- Chikou span (or the Lagging span)

Kumo is the cloud itself. It is the area between Senkou span A and Senkou span B. When using Ichimoku strategy in trading, the cloud’s edges help define present and future support and resistance levels.

The Kumo cloud can take various shapes and heights, according to the price changes. The cloud’s height serves as a volatility indicator as greater price swings happen after thicker clouds. It indicated more powerful support and resistance levels. Traders are often looking for Kumo twists in the future clouds, as they serve as a sign of a possible trend reversal.

Though Ichimoku cloud trading may look rather complicated, the understanding of why and how all these lines are used may help to incorporate Ichimoku in your trading strategy.

Ichimoku cloud explained

How to interpret the ichimoku cloud signals? Basically, this technical indicator provides relevant market information at a glance using averages.Ichimoku confirms an uptrend when the price is above the cloud and a downtrend when the price is below the cloud. There may also be a trendless, or transitioning period when the price remains within the cloud. This area is called a noise zone and should be avoided by traders.

When the Leading span A is moving up above the Leading span B, it helps confirm that the market is in an uptrend. In this case the space between the lines is usually coloured green.

When the Leading span A is moving down below the Leading span B, it may confirm a downtrending market movement. In this case the space between the two lines is usually coloured red.

Traders may also use the Ichimoku cloud to identify the market’s support and resistance areas. The cloud provides support and resistance levels that may be projected into the future. This is an outstanding feature that sets Ichimoku apart from any other technical indicator.

To maximise the effectiveness, it is advised to use Ichimoku cloud in conjunction with other technical indicators. For example, Ichimoku is often combined with the Relative Strength Index (RSI), which helps confirm the momentum in a particular direction.

How to trade with Ichimoku Clouds

As seen below, there are two situations we want to explain here. In the first situation, Tenkan drops below Kijun and provides us with a trading signal that the price action may change its course and form the uptrend shift to a downtrend.

However, at this point both the cloud and Chikou Span are trading below the price action, meaning that the trading signal generated by the relationship between Tenkan and Kijun is not confirmed.

The situation marked by number #2 is different. For some time now, the price action has been moving lower. At one point, USD/JPY breaks under the cloud as the red line still trades below the blue line.

Finally, Chikou is trading below the market’s price, which means that finally all three elements are providing the same bearish signal.

Of course, for the bullish signal you should just apply the reverse logic. You want to enter a long trade if the blue line trades above red, the price action is above the cloud and above Chikou Span.

You are now in a trade and there are two more decisions to be made. One, the stop-loss should be placed above the high of the candle within the cloud formation. Ideally, you should also consult other support and resistance levels before deciding on a stop-loss.

The same applies for a take profit order, which should be set based on the money management principles and risk tolerance. Again, always consult other indicators and technical levels of support and resistance.

Best Ichimoku Strategies

The Ichimoku Cloud is a comprehensive indicator that can be used as a completely standalone indicator. Still, it can be complemented with other tools to deliver low risk, high probability trading signals.In trending markets, it is well complemented by the. For instance, when prices are above the cloud, traders can watch out for bullish Kijun Sen and Tenkan Sen crosses at important Fibonacci levels, such as 38.2% and 61.8%.

Ichimoku consists of multiple lines that can act as support and resistance, but it remains a relatively weak indicator in ranging markets. Ichimoku can tell when a market is ranging, and by combining it with oscillators, such as the and Stochastics, that signal overbought and oversold conditions, traders can pick out optimal entry and exit points in ranging markets.

Summary

- The Ichimoku Cloud is primarily used to identify trend direction, gauge momentum and come up with applicable trading signals.

- It consists of four key elements: the Tenkan Sen, the Kijun Sen, Chikou Span, and Kumo (the cloud)

- Traders primarily monitor three situations: the crossover between Tenkan and Kijun, the point where the cloud breaks of the cloud in one of two directions, and the location of Chikou on the chart.

Post a Comment