Why is the ABCD Pattern important?

- Helps identify trading opportunities in any market (forex, stocks, futures, etc.), on any timeframe (intraday, swing, position), and in any market condition (bullish, bearish, or range-bound markets)

- All other patterns are based on (include) the ABCD pattern.

- Highest probability trade entry is at completion of the pattern (point D).

- Helps to determine the risk vs. reward prior to placing a trade.

- Convergence of several patterns—within the same timeframe, or across multiple timeframes--provide a stronger trade signal.

So how do I find an ABCD pattern?

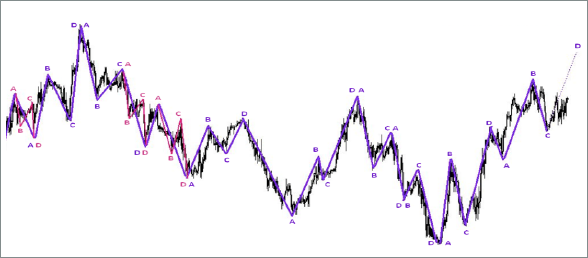

Each pattern has both a bullish and bearish version. Bullish patterns help identify higher probability opportunities to buy, or go "long." Bearish patterns help signal opportunities to "short," or sell.

Each turning point (A, B, C, and D) represents a significant high or significant low on a price chart. These points define three consecutive price swings, or trends, which make up each of the three pattern "legs." These are referred to as the AB leg, the BC leg, and the CD leg.

Trading is not an exact science. As a result, we use some key Fibonacci ratio relationships to look for proportions between AB and CD. Doing so will still give us an approximate range of where the ABCD pattern may complete—both in terms of time and price. This is why converging patterns help increase probabilities, and allow traders to more accurately determine entries and exits.

Each pattern leg is typically within a range of 3-13 bars/candles on any given timeframe, although patterns may be much larger than 13 periods on a given timeframe. Traders may interpret this as a sign to move to a larger timeframe in which the pattern does fit within this range to check for trend/Fibonacci convergence.

There are 3 types of ABCD patterns (each with a bullish and bearish version) in which specific criteria/characteristics must be met.

Bullish ABCD Pattern Characteristics (buy at point D)

Bullish ABCD Pattern Rules

- Find AB

- Point A is a significant high

- Point B is a significant low

- In the move from A to B there can be no highs above point A, and no lows below B

- If AB, then find BC

- Point C must be lower than point A

- In the move from B up to C there can be no lows below point B, and no highs above point C

- Point C will ideally be 61.8% or 78.6% of AB

- In strongly trending markets, BC may only be 38.2% or 50% of AB

- If BC, then draw CD

- Point D must be lower than point B (market successfully achieves a new low)

- In the move from C down to D there can be no highs above point C, and no lows below point D

- Determine where D may complete (price) ---insert fib & abcd tool tutorial link

- CD may equal AB

in price

- CD may be 127.2% or 161.8% of AB in price

- CD may be 127.2% or 161.8% of BC in price

- Determine when point D may complete (time) for additional confirmation –insert fib time tool link

- CD may equal AB in time

- CD may be 61.8% or 78.6% time of AB

- CD may be 127.2% or 161.8% time of AB

- Look for fib, pattern, trend convergence

- Watch for price gaps and/or wide-ranging bars/candles in the CD leg, especially as market approaches point D

- Traders may interpret these as signs of a potential strongly trending market and expect to see 127.2% or 161.8% price extensions

Bearish ABCD Pattern Characteristics (sell at point D)

Bearish ABCD Pattern Rules

- Find AB

- Point A is a significant low

- Point B is a significant high

- In the move from A up to B there can be no lows below point A, and no highs above point B

- If AB, then find BC

- Point C must be higher than point A

- In the move from B down to C there can be no highs above point B, and no lows below point C

- Point C will ideally be 61.8% or 78.6% of AB

- In strongly trending markets, BC may only be 38.2% or 50% of AB

- If BC, then draw CD

- Point D must be higher than point B

- In the move from C up to D there can be no lows below point C, and no highs above point D

- Determine where D may complete (price)

- CD may equal AB in price

- CD may be 127.2% or 161.8% of AB in price

- CD may be 127.2% or 161.8% of BC in price

- Determine when point D may complete (time) for additional confirmation

- CD may equal AB in time

- CD may be 61.8% or 78.6% time of AB

- CD may be 127.2% or 161.8% time of AB

- Look for fib, pattern, trend convergence

- Watch for price gaps and/or wide-ranging bars/candles in the CD leg, especially as market approaches point D

- Traders may interpret these as signs of a potential strongly trending market and expect to see 127.2% or 161.8% price extensions

Post a Comment