Margin Trading: What Is Best Leverage Forex Trading?

As a trader, it is crucial that you understand both the benefits AND the pitfalls of trading with leverage.

Using a ratio of 100:1 as an example means that it is possible to enter into a trade for up to $100 for every $1 in your account.

With as little as $1,000 of margin available in your account, you can trade up to $100,000 at 100:1 leverage.

This gives you the potential to earn profits on the equivalent of a $100,000 trade!

It’s like a super scrawny dude who has a super long forearm entering an arm-wrestling match.

If he knows what he’s doing, it doesn’t matter if his opponent is Arnold Schwarzenegger, due to the leverage that his forearm can generate, he’ll usually come out on top.

When leverage works, it magnifies your gains substantially. Your head gets big and you think you’re the greatest trader that has ever lived.

But leverage can also work against you.

If your trade moves in the opposite direction, leverage will AMPLIFY your potential losses.

You’ll be broke faster than Mike Tyson can chew your ear off.

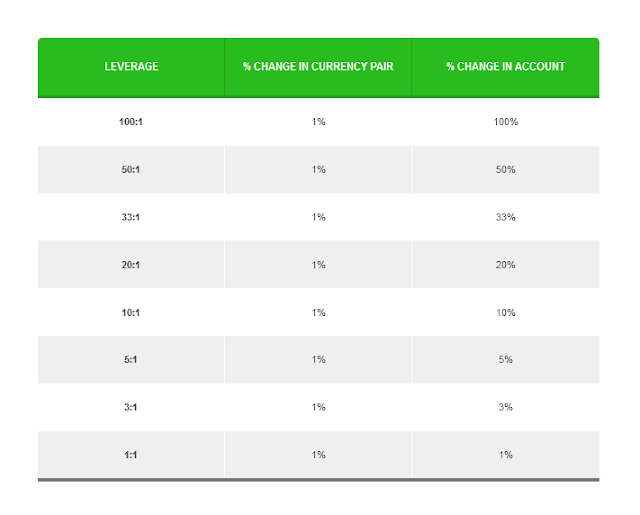

Here’s a chart of how much your account balance changes if prices move depending on your leverage.

Let’s say you bought USD/JPY and it goes up by 1% from 120.00 to 121.20.

If you trade one standard $100K lot, here is how leverage would affect your return:

Let’s say you bought USD/JPY and it goes down by 1% from 120.00 to 118.80.

If you trade one standard $100K lot, here is how leverage would affect your return (or loss):

The more leverage you use, the less “breathing room” you have for the market to move before a margin call.

You’re probably thinking, “I’m a day trader, I don’t need no stinkin’ breathing room. I only use 20-30 pip stop losses.”

Okay, let’s take a look:

Example #1

You open a mini account with $500 which trades $10K mini lots and only requires .5% margin.You buy 2 mini lots of EUR/USD. Your true leverage is 40:1 ($20,000 / $500). You place a 30-pip stop loss and it gets triggered. Your loss is $60 ($1/pip x 2 lots).

You’ve just lost 12% of your account ($60 loss / $500 account). Your account balance is now $440.

You believe you just had a bad day. The next day, you’re feeling good and want to recoup yesterday losses, so you decide to double up and you buy 4 mini lots of EUR/USD.

Your true leverage is about 90:1 ($40,000 / $440).

You set your usual 30-pip stop loss and your trade loses. Your loss is $120 ($1/pip x 4 lots).

You’ve just lost 27% of your account ($120 loss/ $440 account). Your account balance is now $320.

You believe the tide will turn so you trade again. You buy 2 mini lots of EUR/USD. Your true leverage is about 63:1.

You set your usual 30 pip stop loss and lose once again! Your loss is $60 ($1/pip x 2 lots).

You’ve just lost almost 19% of your account ($60 loss / $320 account). Your account balance is now $260.

You’re getting frustrated. You try to think about what you’re doing wrong. You think you’re setting your stops too tight.

The next day you buy 3 mini lots of EUR/USD. Your true leverage is 115:1 ($30,000 / $260).

You loosen your stop loss to 50 pips. The trade starts going against you and it looks like you’re about to get stopped out yet again!

But what happens next is even worse!

You get a margin call!

Since you opened 3 lots with a $260 account, your Used Margin was $150 so your Usable Margin was a measly $110.

The trade went against you 37 pips and because you had 3 lots opened, you get a margin call. Your position has been liquidated at market price.

The only money you have left in your account is $150, the Used Margin that was returned to you after the margin call.

After four total trades, your trading account has gone from $500 to $150. A 70% loss! It won’t be very long until you lose the rest.

A four trade losing streak is not uncommon. Experienced traders have similar or even longer streaks.

The reason they’re successful is because they use low leverage.

Most cap their leverage at 5:1 but rarely go that high and stay around 3:1.

The other reason experienced traders succeed is because their accounts are properly capitalized!

While learning technical analysis, fundamental analysis, sentiment analysis, building a system, trading psychology are important, we believe the biggest factor on whether you succeed as a forex trader is making sure you capitalize your account sufficiently and trade that capital with smart leverage.

Your chances of becoming successful are greatly reduced below a minimum starting capital.

It becomes impossible to mitigate the effects of leverage on too small an account.

Low leverage with proper capitalization allows you to realize losses that are very small which not only lets you sleep at night, but allows you to trade another day.

Example #2

Bill opens a $5,000 account trading $100,000 lots. He is trading with 20:1 leverage.The currency pairs that he normally trades move anywhere from 70 to 200 pips on a daily basis.

In order to protect himself, he uses tight 30 pip stops.

If prices go 30 pips against him, he will be stopped out for a loss of $300.00. Bill feels that 30 pips are reasonable but he underestimates how volatile the market is and finds himself being stopped out frequently.

After being stopped out four times, Bill has had enough. He decides to give himself a little more room, handle the swings, and increases his stop to 100 pips.

Bill’s leverage is no longer 20:1. His account is down to $3,800 (because of his four losses at $300 each) and he’s still trading one $100,000 lot.

His leverage is now over 26:1.

He decides to tighten his stops to 50 pips.

He opens another trade using two lots and two hours later his 50 pip stop loss is hit and he losses $1,000.

He now has $2,800 in his account. His leverage is over 35:1.

He tries again with two lots.

This time the market goes up 10 pips.

He cashes out with a $200 profit.

His account grows slightly to $3,000.

He opens another position with two lots. The market drops 50 points and he gets out. Now he has $2,000 left.

He thinks “What the hell!” and opens another position!

The market proceeds to drop another 100 pips.

Because he has $1,000 locked up as margin deposit, he only has $1,000 margin available, so he receives a margin call and his position is instantly liquidated!

He now has $1,000 left which is not even enough to open a new position.

He lost $4,000 or 80% of his account with a total of 8 trades and the market has only moved 280 pips. 280 pips!

The market moves 280 pips pretty darn easy.

Are you starting to see why leverage is the top killer of forex traders?

As a new trader, you should consider limiting your leverage to a maximum of 10:1. Or to be really safe, 1:1.

Trading with too high a leverage ratio is one of the most common errors made by new forex traders.

Until you become more experienced, we strongly recommend that you trade with a lower ratio.

Example Using Less Leverage

If Trader C has an account with $10,000 cash, she will be able to trade $50,000 of currency.

Each mini-lot would cost $10,000. In a mini lot, each pip is a $1 change.

Since Trader C has 5 mini lots, each pip is a $5 change.

How to Pick the Right Leverage Level

- Maintain low levels of leverage.

- Use trailing stops to reduce downside and protect capital.

- Limit capital to 1% to 2% of total trading capital on each position taken.

If you are conservative and don’t like taking many risks, or if you’re still learning how to trade currencies, a lower level of leverage like 5:1 or 10:1 might be more appropriate.

By using limit stops, investors can ensure that they can continue to learn how to trade currencies but limit potential losses if a trade fails.

These stops are also important because they help reduce the emotion of trading and allow individuals to pull themselves away from their trading desks without emotion.

Beside it, we can see that the margin ratio strongly depends on the strategy that is going to be used.

To give you a better overview, scalpers and breakout traders try to use as high a leverage as possible, as they usually look for quick trades.

Positional traders often trade with low leverage or none at all. A desired leverage for a positional trader usually starts at 5:1 and goes up to about 20:1.

When scalping, traders tend to employ a leverage that starts at 50:1 and may go as high as 500:1.

Knowing the effect of leveraging and the optimal leverage Forex trading ratio is vital for a successful trading strategy, as you never want to overtrade, but you always want to be able to squeeze the maximum out of potentially profitable trades.

Usually a trader is advised to experiment with leverage within their strategy for a while, in order to find the most suitable one.

We hope that this article has been useful to you, and that by now you have clearly understood the nature of gearing, how to calculate Forex leverage, and how it can be equally be useful or harmful to your trading strategy.

It is important to state that margined Forex trading is quite a risky process, and your deposit can be lost quickly if you are trading using large margin.

Do try to avoid any highly leveraged trading when you first start out and before you have gained enough experience.

Post a Comment