BEFORE READING THIS ARTICLE, YOU SEE THE ARTICLES MENTIONED ON CAPITAL MANAGEMENT - BUSINESS RISKS FOREX - CLICK HERE >>

Many people think that Forex like a gamble than the first channel financial resources seriously, simply because of the higher risk seen the opportunity to receive, the number of losers, with knock out east versus overwhelming success, one of the main causes of the "phenomenon of losses" in investment by the original Trader Forex is not knowledgeable about the market , about themselves and especially no concept of risk management, per set trading orders, almost at the mercy of fate luck bad luck, if the profit is fun Take Profit, not blame lack of luck or FX is a specialist nghiep.Do pickpocket, the management skills which is considered the second most important in the field of forex investment. This article shows

dotcomtech.net guide capital management approach combined with risk management (RISK) for each of your orders Trade.

SIMPLE METHOD MANAGEMENT MONNEY

There are well-known trader said " Let the profit loss Quickly shaking and cut của "However, this advice is not always true . What we need to do is to optimize profitability and minimize risk. But does anyone know for sure that the market will increase / decrease how not!? In this post, let's find a way to perfect trading system combined with Money Management (Management fund)

According own experience, I think that a transaction principle converge just 3 factors: There are well-known trader said, "Let the profit loss Quickly shaking and cut của" However, this advice is not always true. What we need to do is to optimize profitability and minimize risk. But does anyone know for sure that the market will increase / decrease how not!? In this post, let's find a way to perfect trading system combined with

Money Management

According own experience, I think that a transaction principle converge just 3 factors:

1 / trend-trend

2 / Support / Resistance

3 / Confirm signal

Trading my system is as follows:

Step 1: Identify key trends (based on the trendline, Channel, Moving avarage) and short-term trends Momentum (Momentum as schools determine trends based on the tilt of underground RSI, MACD, present trend .. towards continuing or reversing warning Divergence Indicator -Not called Momentum)

Step 2: Determine the level of support / resistance (according to Fibonacci, Assemble high point / low in the past)

Step 3: Observe how prices react when approaching these levels Support / Resistence predetermined critical, finding reversal candlestick signal to confirm a strong resistance.

In order after confirming the reversal clearance

Stoploss is placed makes 15-20 pips

Take Profit based on the Fibonacci potential.

Specific examples dealing with situations

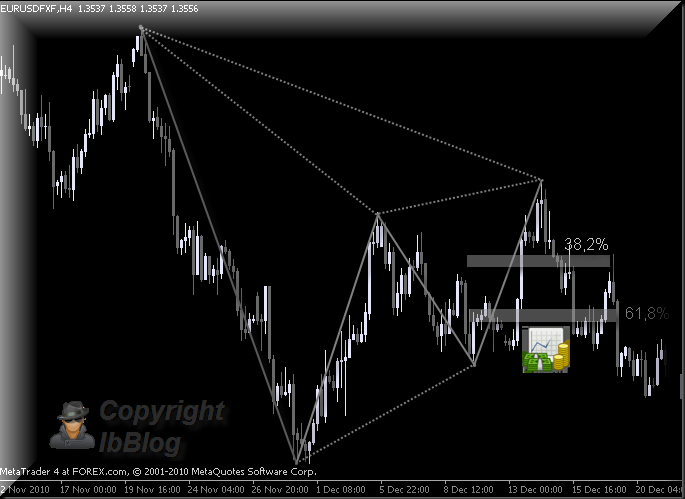

Step 1: Observe the image above, we see that the mainstream: Decrease (Based on the Trendline resistance, short-term trend is also down-to Momentum brief so I can not post the Momentum in. Step 2: The price has rebound when approaching Trendline resistance, in which 78.6% Fibonacci level coincides with the resistance and in the past. Step 3: Appears beam reversal candle candle Top tweetzers-consecutive Many common vertex or unbreakable rupture resistance => resistance levels was confirmed.

=> In order in place if on

=> Stoploss placed on "top" of 15 pips.

TAKE PROFIT POINT WHERE!?

Although the trend is bearish but we need to put the city at price points with the ability to easily access. Here I selected separately adjusted 38.2% Fibonacci level is easier to achieve most goals

TRANSACTION VOLUME HOW!?

According to the strategy, I would set up the transaction as follows:

In order Sell at price $ 1.3960

at $ 1.4010 Stoploss

Take Profit at 1.3890 USD

Total profit = 120 pips

total "damage harmful "= 50 pips

=> Ratio Reward: Risk = 2.4

In principle individual, I choose the proportion Word: Loss reasonable> = 1.5

existing sources: $ 100,000

Percentage% highest risk Acceptable: 1.5% = $ 1,500

1 pip on EURUSD pair value: total loss of 50 pips = $ 500 <$ 1,500

Thus, I can trade two lots with a total loss (if any) = $ 1000

So still in control.

Results of transactions on:

Successful profit

Through this article,

dotcomtech.net want to emphasize the role of capital management, this way there is nothing complicated, just take a moment to mentally calculated "maximum damage" before ordering times and consider opportunities safe or not, if to accept higher risk than the bypass itself, lacking what opportunities await ahead. Start Money management method to protect the safety of your transaction account

your care.

Post a Comment